THE NATIONAL DEBT

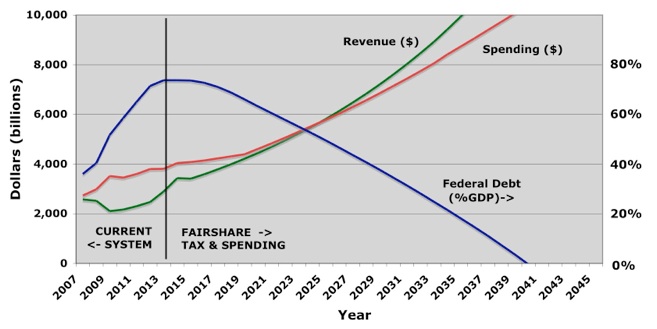

Under the Fair Share Tax Reform, total government taxes (revenues) would be increased about 10% (as a percent of GDP compared to the 2001-10 period, under the Bush tax cuts), although taxes on the typical taxpayer (in fact, the bottom 80%) would be reduced substantially. This would increase revenues from 17.1% to 18.8% of GDP, where they were during the the Clinton Administration, a period of great financial growth that benefited the poor, middle class, and wealthy alike.

The proposed Spending Reforms below, once mostly implemented (after 2020), reduce total government spending by about 18% below current levels (the 2001-10 period), to on average 17.0% percent of GDP. Thus, two dollars of spending would be cut for every dollar in total tax increases under the proposed Fair Share Tax Reform.

If the Fair Share Tax Reform was joined with the Spending Reforms proposed below on this page, our National Debt would start to drop (as a percent of GDP) immediately and could be entirely paid off by 2040. The graph shows the projections for the the Federal Budget based on my best calculations. Alternatively, we could drive the National Debt down to 40% of GDP and cut working-poor and middle class taxes even more substantially starting in about 2030.

CLICK HERE to see the spreadsheet with the calculations that produced the chart below for the Federal Budget. On that page you can download the spreadsheet and see how the National Debt changes if you change tax rates and shift budget priorities. CLICK HERE to download the spreadsheet directly.

GOVERNMENT SPENDING REFORMS

Reforming our tax system to make it more fair an effective is only one side of the coin. Taxation is government income. Reform of government expenditures - using that tax income sensibly - is also critical to the future of our nation.

Below are the proposed Spending Reforms that should accompany the Fair Share Tax Reform. They are used to create the above graph and the accompanying Government Budget Spreadsheet page. The proposed spending cuts, once fully implemented, would reduce total government spending (federal, state, municipal), measured as a percent of GDP, by almost 20% compared to average 2001-2010 levels.

Under the Fair Share Tax Proposal, total government taxes (revenues) as a percent of GDP would be increased by about 10% from 2001-2010 levels back to where they were during the Clinton years. Therefore, the spending-cut to increased-tax ratio is 2 to 1. Despite the revenue increases, taxes on the typical taxpayer (in fact, the bottom 80%) would be reduced substantially.

Combining the Fair Share Tax Reform with all the Spending Reforms below would allow elimination of the federal deficit by 2025.

The national debt could be paid off completely by 2040.

MILITARY SPENDING CUTS

Last year the United States spent $965 billion dollars on our military. When President Eisenhower, former Supreme Allied Commander during World War II, left office during an earnest Cold War with a nuclear-armed industrial giant committed to our destruction, we were spending 50% less on the military (adjusted for inflation). He warned against the defense industry hijacking government in his Military-Industrial Complex farewell address. We are now spending more than FIVE times that spent by the next most militarized country, China. We could cut spending by 30% and still be spending 3.5 times more than China spends. Enough said. My calculations phase in the 30% cut over 5 years and phase out spending on the Iraq an Afghanistan wars over the same period. [If we spent $30 billion on sustainable world hunger programs every year for 10 years - about 3% of what we spend on the military - we could permanently eliminate world hunger. This might be more effective at changing hearts and minds than trying to do so at the point of a gun.] (WashPost link)

HEALTH-CARE SPENDING CUTS

This year the our governments spent about $760 billion on healthcare (Medicare, Medicaid, and Chip). Health-care spending per person in Japan and the western Europe is about half of what we pay here, AND they have better outcomes with better life expectancies (link, link). Within the United States, around the the city of Seattle and at the Mayo Clinic, they spend about 30% less per Medicare patient than the national average, AND have better results. Some regions spend twice as much per Medicare patient as do other regions and have worse results. Certainly we can achieve a 30% cut over 5 years while improving the quality of care. States pay about one-third of all Medicaid costs and should realize similar savings on those expenditures.

How are these cuts achieved while improving the quality of care? Firstly we need to keep the Affordable Care Act. Without it, health costs will continue to skyrocket. Patients, especially the chronically ill, need their care to be better integrated. Physician incentives to profit more from every test and procedure they prescribe must be blunted. Physicians are now paid by the visit, the test, and the procedure rather than for example the "care of an angina patient." This creates a bias to do the extra stress test, cardiac catheterisation, additional testing, and cardiac bypass surgery, when perhaps adjusting medication could produce a better health outcome. Further, often the procedures are done in centers that the physician owns, so he gets both the hospital fee and procedure fee. Where possible, the decision to test or treat should be made by one physician who does not profit from that decision. Perhaps more physicians need to be paid with generous annual salaries, rather than per test and operation. Governments should certainly negotiate with drug companies for the costs of medications. Studying the systems that cost much less would point to further savings. (NYTimes link)(WashPost link)

NOTE: The cuts to military spending and health-care spending will create an outcry from military contractors, some doctors, hospitals, drug companies, and health insurance companies, their lobbyists ... and their minions in governments. They will all of course try to scare the public with imagined catastrophic results ("Chinese invasions!" “soft on communism!” "Death Panels!" “Kill jobs!”). If we wish to save this nation from economic disaster, we simply need to end the unrestrained and wasteful transfer of taxpayer money to the military-medical-industrial complex.

SOCIAL SECURITY REFORM

The Fair Share Tax reform plan saves the working poor and middle class thousands and year. If a small part of that was invested in the taxpayer's simple tax-free account (for education and retirement; established automatically for all employees, with an opt-out provision), then almost all workers would retire in great shape. Social Security could be viewed as a safety net to assure that no-one who contributed to the economy over a lifetime lives their retirement years in poverty. Here are the proposed reforms:

-

Full annual benefits, starting at age 70 would be $18,000 for all unmarried persons or $30,000 for a married couples. (in 2014 dollars; These are the 120% the living-wage line of the proposed tax reform and roughly equal to the current average benefit). Early initiation of Social Security benefits, as early as age 60, reduces annual benefits. Only high-end earners would receive a smaller benefit than they are now slated to receive. There is no Medicare premium taken out of Social Security benefits.

-

-

The above change in benefits would be delayed until 2024 and then phased in over 10 years, to give workers the opportunity to adjust fund their tax-free accounts and otherwise adjust their retirement planning accordingly. It would reduce projected Social Security spending by about $115 billion (about 4%) when completely phased in and going forward.

-

-

Under the Fair Share Tax Plan, the regressive and indirect current payroll (Social Security) taxes are ended. Instead Social Security benefits are paid out of general revenue. Eligibility for full benefits would require 40 years of filing a tax return with an income corresponding to at least full-time work at the minimum wage (during the transition, payment of the “old” Social Security payroll tax would count as a year toward the 40) OR a lifetime declared income of $6 million (in 2014 dollars) with at least 10 years of filing an at-least-minimum-wage tax return. Partial benefits are prorated down to 25% benefits for 10 years of at-least-minimum-wage work (or $1.5 million lifetime declared income with at least 5 years of filing an at-least-minimum-wage tax return).

-

-

Eligibility for disability benefits would be tightened. Government-funded or mandated disability payments should only pay a living wage for 1) "total disability" that precludes any work more than 5 hours a week (reevaluated no less than every 5 years), 2) a supplement for those capable less than 40 hours of work a week, or 3) up to two years during recovery and retraining following the disability onset.

VARIOUS FEDERAL SPENDING CUTS

Below are selected federal government spending cuts derived from the Simpson-Bowles report as described at the New York Times website. I have selected the spending cuts that look sensible to me and excluded those that are already covered under the spending cuts outlined above. The values listed are the expected savings for 2015 if the cuts were enacted and total $124 billion for that year.

[THE FOLLOWING ARE COPIED DIRECTLY FROM THE NEW YORK TIMES WEBSITE]

"

Eliminate farm subsidies

Many economists argue that farm subsidies distort the workings of the market and largely flow to big agricultural businesses. As the Congressional Budget Office has noted, advocates of reducing the subsidies argue that doing so “could help small farms indirectly, slowing the rate” of consolidation. Supporters argue that the subsidies help preserve the American agriculture industry. $14 billion

Cut pay of civilian federal workers by 5 percent

“During the Great Recession, most private-sector employees have seen their wages frozen, and some have even watched wages decline,” the chairmen of the deficit panel wrote. “In contrast, federal workers have seen their wages increase.” This option would be a one-time 5 percent cut in federal civilian workers’ pay; the chairmen called for a three-year freeze on pay, which would have a similar effect. $14 billion

Cut 250,000 government contractors

In the past decade, both the number of federal employees and the number of contractors rose. Recent estimates suggest that contractors outnumber federal employees by millions. The chairmen wrote, “While contractors provide useful services — sometimes at a lower cost than the federal government — their numbers are simply too high in light of the current budget deficit.” $17 billion

Other cuts to the federal government

The chairmen called for a series of smaller cuts, including eliminating some agencies, cutting research funds for fossil fuels, reducing funds for the Smithsonian and the National Park Service, eliminating certain regional subsidies, and eliminating the Office of Safe and Drug-Free Schools. $30 billion

Reduce nuclear arsenal and space spending

Would reduce number of nuclear warheads to 1,050, from 1,968. Would also reduce the number of Minuteman missiles and funding for nuclear research and development, missile development and space-based missile defense. $19 billion

Tighten eligibility for disability

The costs of the disability insurance program, which is administrated by the Social Security Administration, have been rising rapidly. This option would cut disability spending by 5 percent by focusing on states with the loosest standards. Supporters note that growing numbers of workers are classified as disabled, though the average job is less physically taxing. Opponents worry that injured or ill workers with few good job prospects would be harmed. $9 billion

Use an alternate measure for inflation

Some economists believe that the Consumer Price Index overstates inflation, giving Social Security recipients larger cost-of-living increases than necessary. This option would use a different, lower inflation measure both for Social Security and in the tax code (thus pushing more households into higher brackets over time). Supporters say the lower measure is more accurate. Opponents say it is less accurate for the elderly, who buy a different mix of goods and services than other households.

$21 billion

"

[THE ABOVE ARE COPIED DIRECTLY FROM THE NEW YORK TIMES WEBSITE]

FEDERAL SPENDING INCREASES

Over the last 30 years federal non-discretionary spending as a percent of GDP has been cut in half to about 2.5% of GDP. Non-discretionary spending funds things like basic science research, road and railways, environmental protection, sustainable energy research, education, and job training - all critical to future economic growth. The American Society of Civil Engineers has given the nation’s infrastructure an overall grade of D. To ensure future economic prosperity, the federal government's spending on infrastructure, research, and the environment should be tripled and 150 billion added to federal education spending. Together this would cost an extra 380 billion in 2014 and further increased 2% beyond inflation each year going forward. All this additional spending is included in the pay down of the national debt pictured at the top of this page.

STATE AND LOCAL SPENDING

The biggest threats to state and local government budgets are that there are over-generous salaries, benefits, and retirement plans for some government workers. Those workers should have the right to unionize and negotiate work rules and compensation. Governments must honor commitments already made but should request give-backs (eg to avoid layoffs) where appropriate. Going forward, statute should limit total compensation to those available for equivalent work in the private sector.

State and local governments should improve public education, especially in the worst schools. This would involve increased spending, but subject to the compensation guidelines above. The Spending Plan includes a 20% increase beyond inflation in state and municipal education spending phased in over 5 years.

A bit of history: President Clinton's tax increases - which had the wealthy pay something closer to their fair share - balanced the federal budget and produced our first federal surplus in decades. When President Clinton fought for it, Republicans warned again and again that the tax increases would "kill jobs." (Sound familiar?) Instead we had 8 years of the best economy and lowest unemployment in our history and the first budget surpluses in three decades. The Republicans then cut taxes on the wealthy, started running up the national debt, and we now have the worst economy and bleakest employment prospects in 80 years.

CRITICAL PAGES: HOME ROMNEY TAXES SUMMARY IMAGINE! HELP US!.

SEE FULL NAVIGATION MENU BENEATH PHOTOS AT TOP OF PAGE

FAIR SHARE TAX REFORM - A comprehensive tax reform plan for federal, state and local governments, that reduces total taxes on the working-poor and middle-class by thousands each year, encourages stable economic growth, vastly simplifies our tax laws, and slashes the national debt.

COPYRIGHT - FAIR SHARE TAXES - ALL RIGHTS RESERVED

CONTACT ME: fairsharetaxes@att.net